Navigating the Nuances of Financial Advisor Payouts: Insights and Strategies

Navigating the Nuances of Financial Advisor Payouts: Insights and Strategies

As a financial advisor, the path to maximizing earnings and leveraging the benefits of independence is both intricate and laden with potential. My journey into the realms of financial advising, underpinned by personal endeavors and collaborative ventures, has ingrained a profound understanding of the pivotal aspects of advisor payouts. This reflective exploration seeks to distill those learnings, offering a beacon for advisors at the crossroads of growth and independence.

The Genesis of Financial Advisory Evolution

The initiative to empower my team and our joint venture, Arc, through the acquisition of knowledge via books, was a step toward demystifying the complexities of the financial advisory space. This endeavor, although fraught with trial and error, has illuminated the path not only for myself but for others seeking to navigate the intricacies of financial advising. Our philosophy at Arc underscores the essence of choice and alignment with personal growth trajectories, whether through traditional growth avenues or innovative strategies like book purchases.

Understanding Payouts in the Independent Sphere

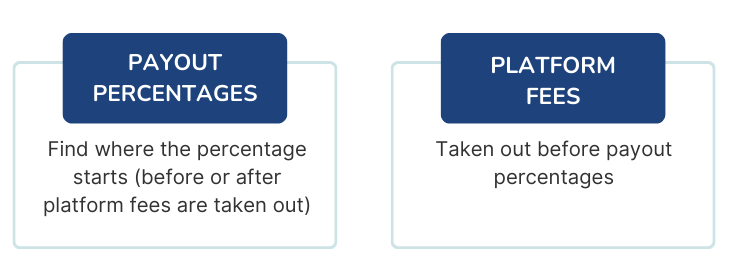

The allure of independence in financial advising is significantly tethered to the prospect of higher payouts. However, the structure of these payouts is often misunderstood, encapsulated in misconceptions about payout percentages and the hidden depths of platform fees. The dual-layered reality of payouts—comprising both the payout percentage and platform fees—demands a nuanced understanding to truly grasp the financial implications of moving to or operating within the independent advisory space.

The Dual Components of Payouts

At the heart of financial advisory payouts lie two critical components: the payout percentage and platform fees. These pieces, while seemingly straightforward, can get muddled if you aren't asking the right questions. Platform fees, often the less transparent of the two, are deducted upfront, influencing the net payout. This structure underscores the importance of clarity and transparency in comprehending how payouts are calculated, ensuring advisors are equipped with a comprehensive understanding of their earnings.

Enhancing Transparency and Understanding

Our approach at ARC has been to elevate the level of transparency surrounding payouts, providing advisors with a detailed breakdown of their earnings. This includes not only the payout percentage but also the impact of platform fees, enabling a clearer perspective on the true net payout. By mirroring and enhancing practices from industry leaders, we aim to foster an environment of informed decision-making for our advisors.

Beyond Payout Percentages: The Impact of Expenses

The discussion of payouts would be incomplete without addressing the pivotal role of expenses in shaping net earnings. Advisors should take a deep dive into the various expenses associated with their operations, from administrative fees to the cost of software and support services. Understanding these expenses is crucial for accurately assessing potential earnings within the independent space.

The Path Forward: Transition Assistance and Due Diligence

As advisors contemplate the move to independence, the concept of transition assistance emerges as a significant factor. This upfront financial support, while enticing, must be weighed against the long-term payout structure and associated obligations. Due diligence, encompassing a thorough examination of all factors affecting payouts and expenses, is indispensable in making an informed decision.

Embracing Independence with Informed Confidence

The journey toward independence in the financial advisory sector is a testament to the pursuit of autonomy and optimized earnings. By embracing a mindset of continuous learning and due diligence, advisors can navigate the complexities of payouts and expenses with confidence. At ARC, our commitment to transparency, education, and support serves as a cornerstone for advisors seeking to realize their full potential in an independent landscape.

Investment advice offered by Advisor Resource Council, a registered investment advisor.